As the digital landscape evolves, Web3 is emerging as the next frontier, promising to revolutionize the internet with decentralized protocols and technologies. Unlike its predecessors, Web1.0 and Web2.0, Web3 offers greater security, transparency, and user empowerment. This comprehensive guide will walk you through everything you need to know about investing in Web3. From understanding the basics of cryptocurrencies and NFTs to exploring advanced topics like decentralized finance (DeFi) and the metaverse, we’ll equip you with the knowledge and tools to navigate this exciting new investment landscape. Dive in and discover how to capitalize on the future of the internet.

What is Web3?

Web3 represents the third generation of internet technology, characterized by its decentralized nature. Unlike Web1.0, which focused on static pages, and Web2.0, which introduced dynamic content and social interaction, Web3 aims to provide a more secure and user-centric internet experience. At its core, Web3 uses blockchain technology to decentralize data storage and enable peer-to-peer transactions. This allows for increased transparency, security, and control over personal information. In essence, Web3 empowers users by giving them more authority over their data and how they interact with online services, marking a significant shift from the centralized models of the past.

Differences Between Web1.0, Web2.0, and Web3

Web1.0 marked the inception of the internet, characterized by static web pages and limited user interaction. During this era, websites were primarily informational, offering read-only content without much scope for user-generated input or community building. Web2.0 revolutionized the internet with interactive platforms, social media, and user-generated content, fostering dynamic and bidirectional communication. This period saw the rise of centralized services like Facebook, Google, and Twitter, which allowed users to contribute and share content but often at the cost of privacy and data ownership. Web3, the latest evolution, aims to decentralize the web using blockchain technology, offering greater control to users over their data and online identities. It prioritizes peer-to-peer interactions, enabling decentralized applications (dApps) and smart contracts that operate without intermediaries. Web3 envisions an internet where users are stakeholders, contributing to and benefiting directly from the network.

Why Invest in Web3?

Investing in Web3 presents an opportunity to be at the forefront of the latest technological advancements. As traditional internet models face limitations in scalability, security, and user autonomy, Web3 offers solutions through its decentralized framework. By leveraging blockchain technology, Web3 reduces intermediary control, enhances data privacy, and creates a more user-centric internet experience. Furthermore, early Web3 investments in technologies such as cryptocurrencies, NFTs, and decentralized applications (dApps) have shown significant potential for high returns. Beyond financial gains, investing in Web3 supports a shift towards a more transparent and equitable digital ecosystem. Embrace the future and consider the impactful benefits of Web3 investments.

Common Web3 Investment Options

Investing in Web3 can be an exhilarating journey, offering a multitude of avenues to diversify your portfolio. Cryptocurrencies remain a cornerstone, with popular assets like Bitcoin and Ethereum leading the charge. Another burgeoning sector is Non-Fungible Tokens (NFTs), which are unique digital assets representing ownership of art, music, and other forms of media. Additionally, Decentralized Finance (DeFi) platforms offer innovative financial services like lending, borrowing, and trading, all without traditional intermediaries. For those looking to the future, investing in metaverse projects can offer exposure to virtual worlds and augmented reality experiences. Each of these options presents unique opportunities and risks, making it crucial to conduct thorough research and stay informed.

Step 1: Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. Bitcoin, the first and most well-known cryptocurrency, introduced the concept of a decentralized ledger that records all transactions across a network of computers. Understanding the fundamental principles of how cryptocurrencies work, including mining, transactions, and the underlying blockchain technology, is essential for anyone looking to invest in Web3. This foundational knowledge will provide you with the confidence to navigate the broader spectrum of digital assets available in this new financial ecosystem.

Step 2: Exploring NFTs (Non-Fungible Tokens)

NFTs, or Non-Fungible Tokens, represent a pivotal innovation in the digital world, offering unique ownership and authenticity verified through blockchain technology. Unlike traditional cryptocurrencies, NFTs are indivisible and unique, making them ideal for representing digital art, collectibles, virtual real estate, and even gaming assets. Understanding NFTs is crucial for any investor looking to delve into Web3, as they provide new opportunities for creatorship and monetization. In this section, we’ll explore the underlying technology, the various marketplaces where NFTs can be bought and sold, and tips for identifying valuable and promising NFT investments. Get ready to unlock the potential of digital scarcity and ownership in the rapidly growing NFT ecosystem.

Step 3: Investing in Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is one of the most exciting areas within the Web3 ecosystem. It represents a shift from traditional financial systems to peer-to-peer finance enabled by blockchain technology. DeFi platforms provide a range of financial services, such as lending, borrowing, trading, and earning interest, all without intermediaries like banks. This opens up new opportunities for investors to achieve higher returns, access diverse financial products, and participate in a truly global and inclusive financial system. However, like any investment, DeFi comes with its own set of risks, including smart contract vulnerabilities and market volatility. By understanding the core principles and staying informed about the latest developments, you can effectively navigate the DeFi landscape and make informed investment decisions.

Step 4: The Role of Blockchain in Web3 Investments

Blockchain technology is the backbone of Web3, offering a secure, transparent, and immutable ledger that underpins decentralized applications (dApps) and protocols. By eliminating intermediaries, blockchain enables peer-to-peer transactions, reducing costs and enhancing trust among users. In the realm of Web3 investments, understanding blockchain is crucial. It provides the foundation for various investment opportunities, from cryptocurrencies like Bitcoin and Ethereum to innovative financial instruments in decentralized finance (DeFi). Additionally, blockchain enhances the provenance and authenticity of digital assets, making it integral to the growing markets of NFTs and the metaverse. As you delve into Web3 investments, a solid grasp of blockchain will empower you to make informed decisions and stay ahead of the curve in this rapidly evolving landscape.

Step 5: Virtual Real Estate in the Metaverse

The metaverse is quickly becoming a significant investment avenue with its expansive digital environments. Virtual real estate offers a unique opportunity to own, develop, and monetize digital plots within these immersive worlds. Unlike physical land, virtual properties are limited only by the boundaries of creativity and technological capability. Investors can purchase, lease, or trade virtual spaces, creating revenue streams through advertisements, virtual commerce, and hosting events. By understanding the dynamics of virtual real estate, you’ll be poised to take advantage of one of the most innovative and rapidly growing sectors in the Web3 landscape.

Building and Launching Your Web3 Project

Embarking on a Web3 project involves a unique set of steps compared to traditional web development. To start, you’ll need a solid understanding of blockchain technology and smart contracts, since these are the backbone of Web3 applications. Selecting the right blockchain platform—such as Ethereum, Binance Smart Chain, or Solana—plays a critical role in determining your project’s scalability and security. Once the underlying technology framework is in place, focus on developing a decentralized application (dApp) that addresses a specific user need or market gap. Consider integrating tokenomics to incentivize user engagement and foster a sustainable ecosystem around your project. Testing and security audits are crucial to ensuring your project operates flawlessly and is free from vulnerabilities. Finally, plan a comprehensive launch strategy that includes marketing, community building, and potential partnerships to drive adoption and growth. With meticulous planning and execution, your Web3 project can become a pivotal player in the decentralized future of the internet.

Investing in Web3 Stocks

As the paradigm shifts towards decentralized technologies, investing in Web3 stocks becomes an attractive opportunity for forward-thinking investors. Companies developing blockchain infrastructure, decentralized applications (dApps), and other Web3 innovations are poised for significant growth. By understanding the landscape of these emerging markets, you can strategically allocate your portfolio to include stocks of pioneers and leaders in the Web3 space. This approach not only diversifies your investments but also aligns your portfolio with the future trajectory of the internet. Stay ahead of the curve by identifying potential blue-chip Web3 companies and investing early in this transformative phase.

Funding Web3 Projects

Securing financial backing for Web3 projects involves innovative approaches, leveraging decentralized funding mechanisms like Initial Coin Offerings (ICOs), Security Token Offerings (STOs), and Decentralized Autonomous Organizations (DAOs). These methods democratize investment opportunities, allowing anyone to contribute to promising projects. Crowdfunding platforms based on blockchain technology also play a pivotal role, providing transparent and trustless environments for raising capital. To successfully fund a Web3 project, creators must cultivate a strong community, present a clear value proposition, and ensure robust security measures. By embracing these decentralized funding strategies, Web3 projects can access the financial resources needed to drive technological evolution.

Participating in Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs)

Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs) represent innovative fundraising mechanisms within the Web3 ecosystem. Through ICOs, projects sell tokens to early supporters and investors before the official launch, providing a unique opportunity to support emerging technologies at their inception. Conversely, IDOs take place on decentralized exchanges, enhancing liquidity and democratizing access to early-stage investments by eliminating intermediaries and enabling real-time trading. Whether engaging in an ICO or IDO, it is crucial to conduct thorough research, assess the project’s whitepaper and roadmap, and understand the associated risks. By participating in these offerings, investors can potentially gain early access to groundbreaking projects and contribute to the decentralized future of the internet.

Earning Passive Income Through Staking and Yield Farming

With the rise of decentralized finance (DeFi), earning passive income has never been more accessible. Staking and yield farming offer lucrative opportunities for crypto enthusiasts to grow their holdings without active trading. Staking involves locking up your cryptocurrency in a network to support operations, such as validating transactions, and in return, you earn rewards. Yield farming, on the other hand, involves providing liquidity to DeFi platforms, which then generate returns through interest, fees, or new tokens. Both methods come with their own sets of risks and rewards, but with proper research and strategic planning, you can harness the power of decentralized finance to build a steady stream of passive income.

Investing in Decentralized Applications (dApps)

Decentralized Applications, commonly known as dApps, are a pivotal element in the Web3 ecosystem. Unlike traditional applications, dApps run on blockchain networks, offering increased security, transparency, and resilience. These applications eliminate the need for intermediaries, allowing for peer-to-peer interactions and transactions. Investing in dApps involves understanding the unique frameworks they operate on, such as Ethereum, Binance Smart Chain, and Solana, among others. Each of these platforms brings its own set of benefits and risks, which investors must carefully evaluate. By tapping into the innovative potential of dApps, you can invest in projects that aim to disrupt various industries, from finance and supply chain to gaming and social media. This section will guide you on how to assess the viability of dApps, explore potential use cases, and identify promising investment opportunities. Equip yourself with the insights to navigate the dApp landscape and make informed investment decisions.

Understanding the Risks of Web3 Investments

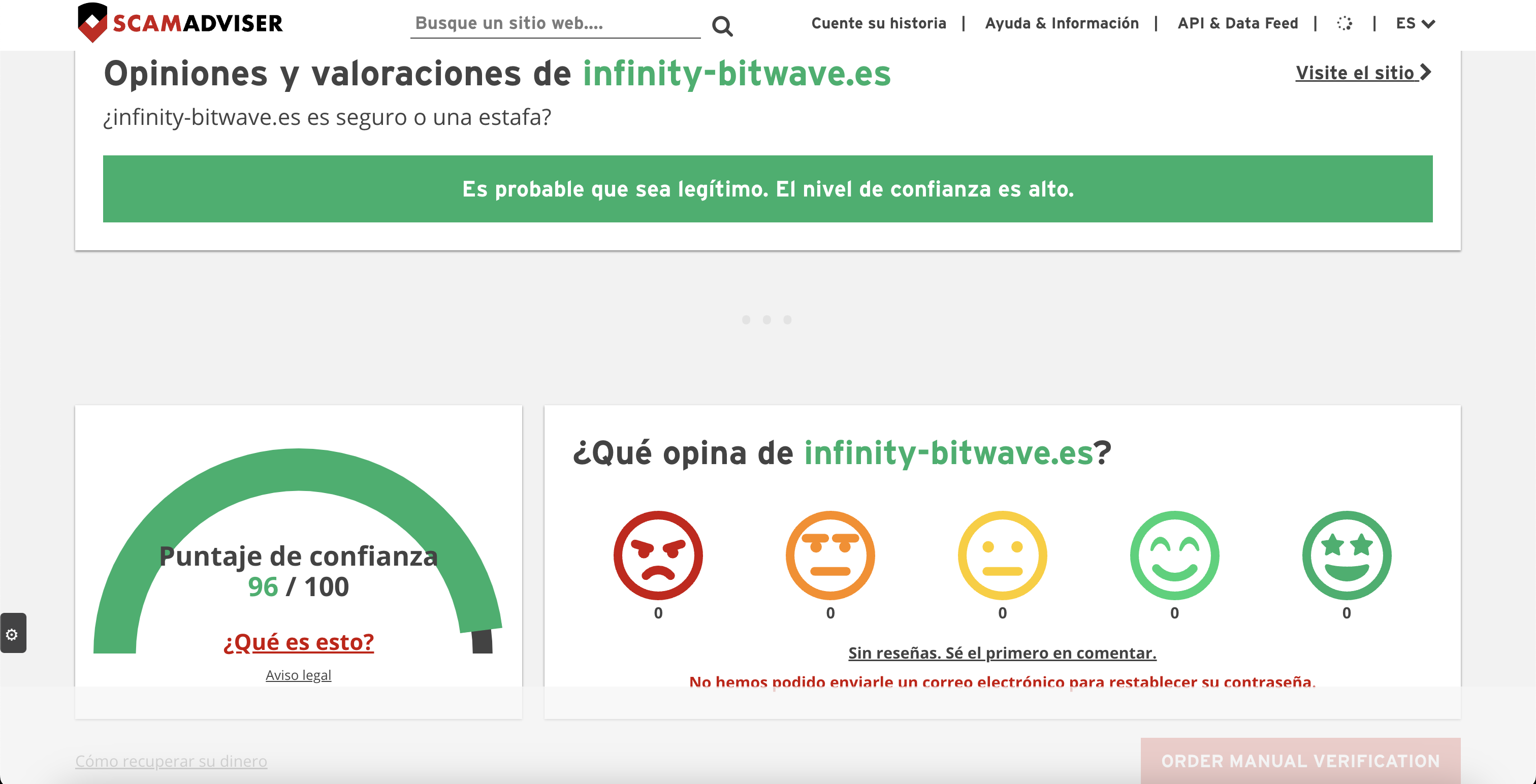

Diving into Web3 investments presents both significant opportunities and considerable risks. Unlike traditional investments, Web3 technologies are still in their early stages, making them inherently volatile and speculative. Market fluctuations can be extreme, driven by factors such as regulatory changes, technological advancements, or market sentiment. It’s crucial to recognize the potential for security vulnerabilities, including hacking and smart contract flaws, which can lead to substantial financial losses. Additionally, the decentralized nature of Web3 means that there is often no central authority to turn to for recourse in the event of disputes or fraud. By thoroughly researching projects, understanding the underlying technology, and maintaining a diversified portfolio, investors can better navigate the uncertainties of the burgeoning Web3 landscape.

How to Secure Your Web3 Investments

Securing your Web3 investments is crucial in maintaining the integrity and value of your digital assets. Start by using secure digital wallets that offer robust encryption and multi-factor authentication. Understand the importance of private keys and never share them with anyone. Regularly update your software to protect against security vulnerabilities and consider using hardware wallets for additional layers of protection. Be cautious about phishing scams and double-check the authenticity of platforms before engaging in transactions. By taking these proactive steps, you can safeguard your investments in the decentralized world of Web3.

Future Trends in Web3

As Web3 continues to gain momentum, several key trends are emerging that will shape its development and integration into everyday life. These include the rise of decentralized autonomous organizations (DAOs), which enable community-driven decision-making and project funding, and the increased use of smart contracts to automate and secure transactions. Additionally, the expansion of the metaverse will create immersive digital environments for social interaction, work, and play. Enhanced privacy and data ownership will also be at the forefront, empowering users to control their information on their own terms. Keeping an eye on these trends will be crucial for anyone looking to invest in and benefit from the evolving Web3 ecosystem.

Frequently Asked Questions (FAQs) About Web3 Investments

Embarking on Web3 investments can feel overwhelming, especially for newcomers. This section addresses some of the most common queries to help demystify the complexities of this innovative space. You’ll find answers to questions about the fundamentals of Web3, the risks and rewards associated with decentralized technologies, and practical advice for getting started. Whether you’re curious about the intricacies of blockchain, eager to learn about the potential of NFTs, or seeking guidance on DeFi platforms, our FAQs provide the essential information you need to make informed investment decisions. Explore these frequently asked questions to enhance your understanding and confidently venture into the world of Web3.

Final Thoughts on Investing in Web3

In conclusion, investing in Web3 represents a transformative opportunity, bridging the gap between traditional financial systems and the decentralized future. As this technology continues to mature, it is crucial to stay informed and adaptable, given the rapid pace of innovation. Diversifying your investments across various aspects of Web3, such as DeFi, NFTs, and blockchain infrastructure, can provide balanced exposure to potential growth areas. Remember to conduct thorough research, be mindful of risks, and stay updated with the latest trends and regulatory developments. By doing so, you’ll be well-positioned to make informed decisions and potentially capitalize on what many consider the next evolution of the internet.

Leave a Reply